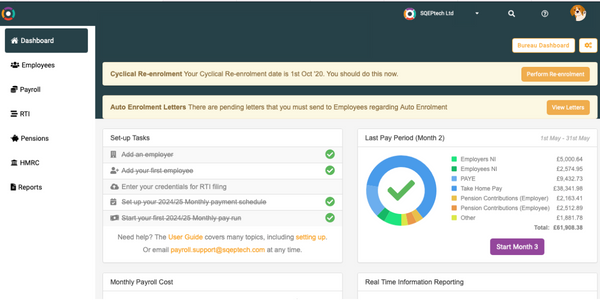

Auto Enrolment Payroll Software

Every UK employer must provide the option for employees to join a pension scheme and contribute towards it. Auto enrolment and pension provision has been a legal requirement for all employers since the Pensions Act of 2008 which came fully into force in 2012. SQEPpay’s payroll software makes managing pension enrolment, re-enrolment, and HMRC pension submissions simple

With the right tools, auto enrolment could be your best friend.

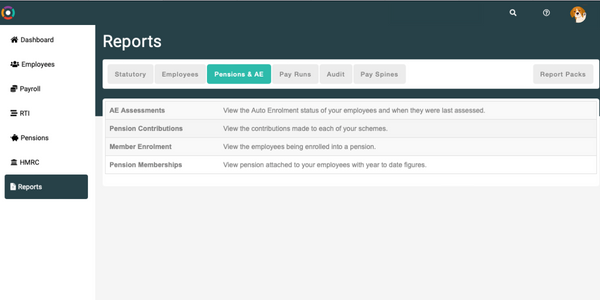

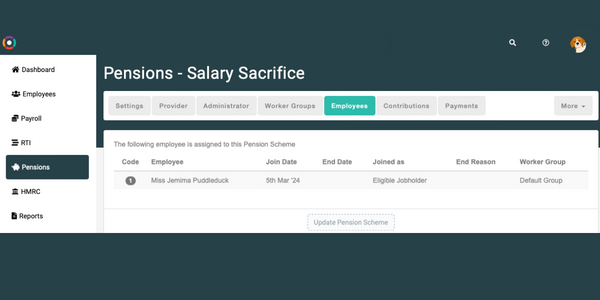

SQEPpay automatically asseses each employee for every pay run (you can also assess an employee whenever you like with a click of a button). We’ll tell you instantly whether the legislation classifies them as an Eligible Jobholder, Non-eligible Jobholder or an Entitled Worker.

As soon as an employee’s status changes, we’ll update your payrun, ensuring you remain compliant every time and giving you valuable time back.

With features like:

🔗 Automatically link with selected pension

📈 Get automatic assessments of eligibility status for each employee

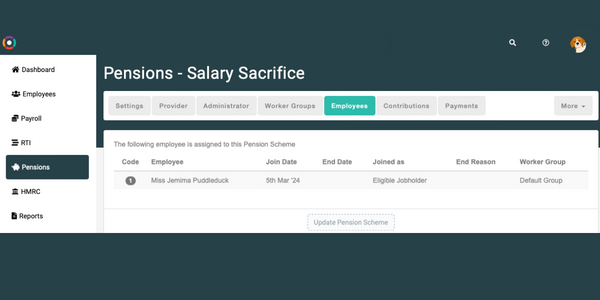

💰 Easily manage pension opt-in and opt-out

🗂️ Generate files and letters automatically, ready to be sent

What’s not to love about SQEPpay?

With competitive pricing, intelligent automation, and an intuitive interface, our payroll software makes pension management and auto-enrolment easy.

As we are a UK-based company that only provides UK payroll and HR solutions, all of our development goes into ensuring our software is as up to date as possible with the latest changes and regulations and with our API capabilities, you can link to your pension provider.

Manage enrolment responsibility with ease

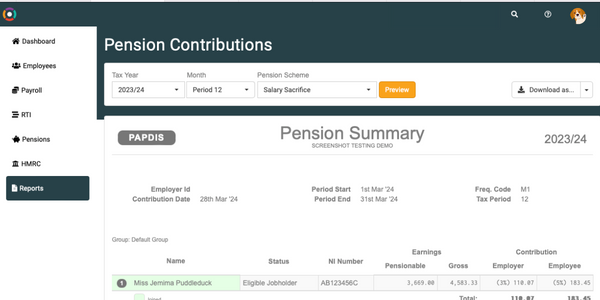

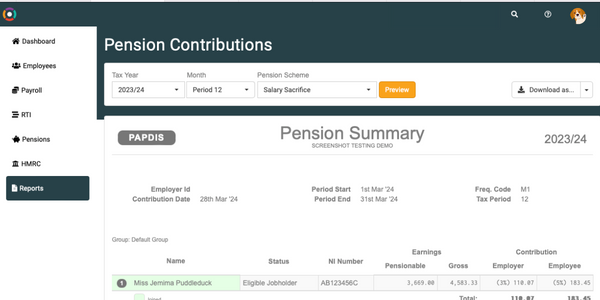

Connect using PAPDIS with any eligible provider

Pension letters ready at the click of a button

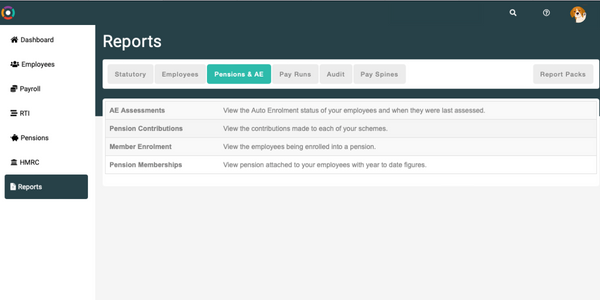

We have automated links for the following pension schemes: